Renters Insurance in and around Kensington

Kensington renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is good to have, even if you think you could afford to replace lost or damaged possessions.

Kensington renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

It's likely that your landlord's insurance only covers the structure of the townhome or apartment you're renting. So, if you want to protect your valuables - such as a bicycle, a couch or a tool set - renters insurance is what you're looking for. State Farm agent Tim Navarro has a true desire to help you choose the right policy and protect your belongings.

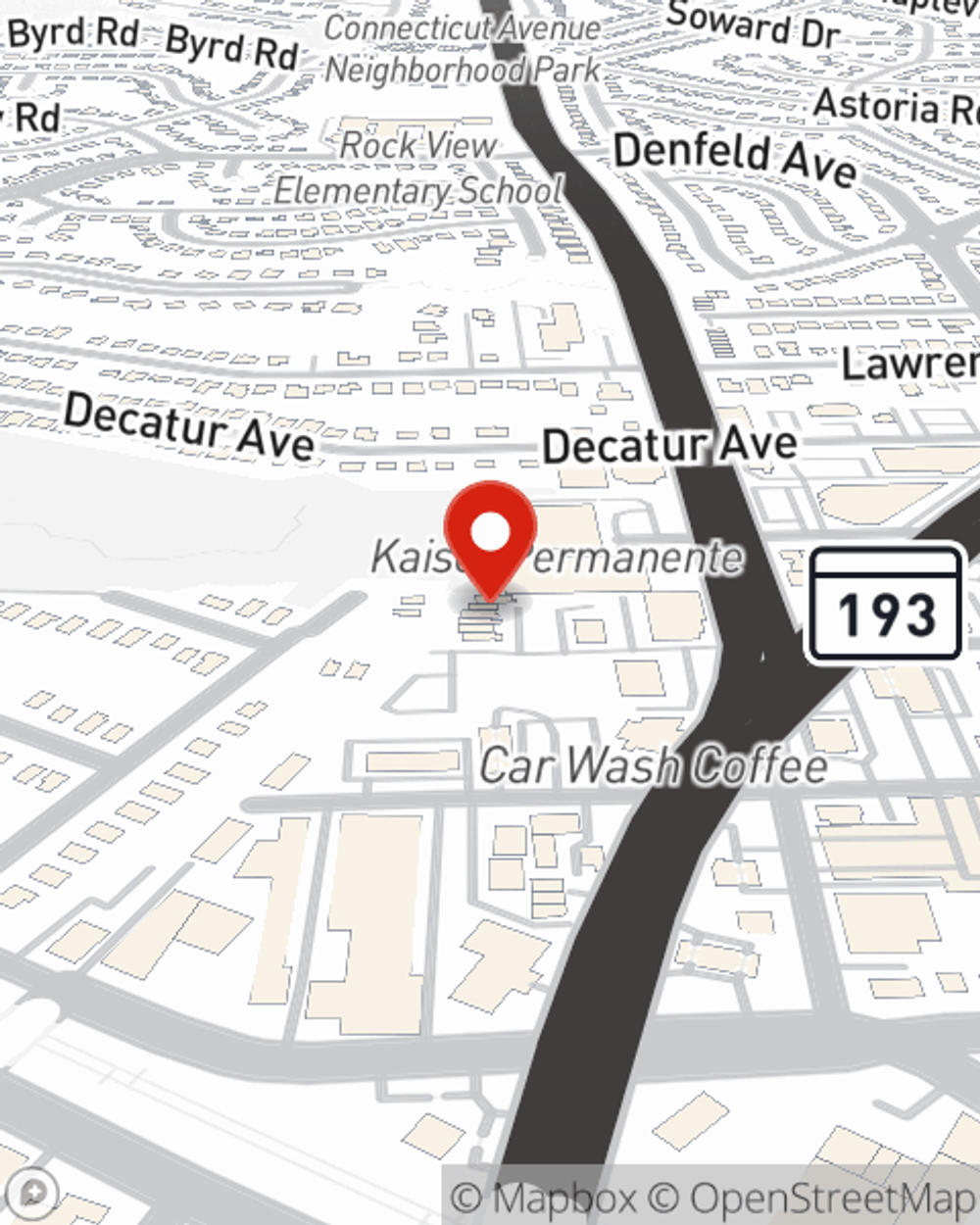

A good next step when renting a condo in Kensington, MD is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online now and see how State Farm agent Tim Navarro can help you.

Have More Questions About Renters Insurance?

Call Tim at (301) 933-1666 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Tim Navarro

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.